In*credible

PayLater for

your Business

PayLater Solutions for your brand, your business model and your customers. Whether online or at the point of sale. The most popular payment methods, powered by Payla.

In*credible

PayLater for

your Business

PayLater Solutions for your brand, your business model and your customers. Whether online or at the point of sale. The most popular payment methods, powered by Payla.

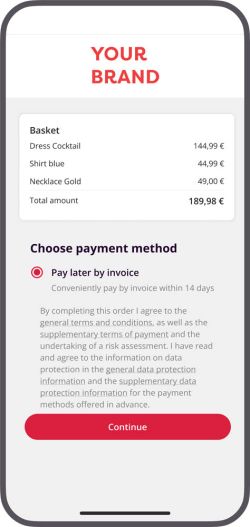

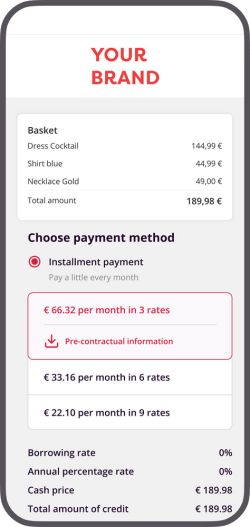

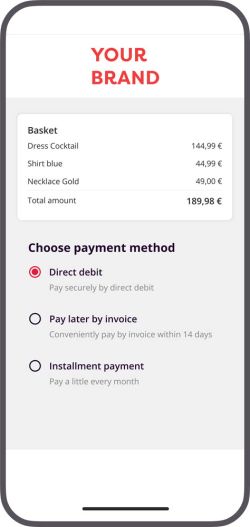

Genuine white label

Purchase

on account

Payment

by installments

Direct

debit

One of the preferred payment methods in Germany. Perfect for subscription payments and recurring payments. Our white label solution integrates quickly and easily into your checkout process.

Why Payla

We understand Buy Now, Pay Later like no other. Payla’s founders have years of industry experience, directly or as a service provider for all leading BNPL provider in Europe. Experiences that our team can draw on today and in the future. Our accumulated expertise has been incorporated into a new generation of BNPL technology. And we love what we do!

Payla pursues the most consistent whitelabel approach on the market. Your customers remain your customers – Payla is not a consumer brand. Along the entire customer journey and at every conceivable touchpoint, Payla ensures that your brand is at the forefront. This makes Buy Now, Pay Later your tool for promoting customer loyalty and increasing your sales.

We understand Buy Now, Pay Later like no other. Payla’s founders have years of industry experience, directly or as a service provider for all leading BNPL provider in Europe. Experiences that our team of over 45 employees can draw on today and in the future. Our accumulated expertise has been incorporated into a new generation of BNPL technology. And we love what we do!

All our products and services are developed in-house. Payla delivers everything from a single source. This ensures that the entire process is tailored to your requirements and those of your customers.

Payla pursues the most consistent white label approach on the market. Your customers remain your customers – Payla is not a consumer brand. Along the entire customer journey and at every conceivable touchpoint, Payla ensures that your brand is at the forefront. This makes Buy Now, Pay Later your tool for promoting customer loyalty and increasing your sales.

Regardless of whether you want to integrate the Payla standard via “Plug & Play” or configure the product for your specific needs, Payla connects you quickly and easily via our APIs and web services. You also determine the level of integration – all our customer applications are optional – you can embed them in your existing apps or infrastructure.

Your customers are our most important asset. That’s why Payla offers excellent customer support service via various channels: Email, phone and chat. And if you wish, we can act on your behalf.

In addition to continuous product development, we also deal intensively with current regulatory requirements and take care of the important issue of data and consumer protection. We also address new issues relating to responsible lending for consumers.

Choose the BNPL payment methods you need from our range and we will offer you transparent and fair conditions. With Buy Now, Pay Later from Payla, you can offer your customers the most attractive payment methods currently available without risk, regardless of whether the buyer pays for the goods at the end. This also applies to cases of fraud. You bear no default risk.

Wir verstehen Buy Now Pay Later wie kein anderer. Die Gründer von Payla haben jahrelange Branchenerfahrung, direkt oder als Dienstleister für alle führenden BNPL-Anbieter in Europa. Erfahrungen, auf die unser Team von über 45 Mitarbeiter:innen heute und in Zukunft zurückgreifen kann. Unsere gesammelte Expertise ist in eine neue Generation von BNPL-Software eingeflossen. Und wir lieben das, was wir tun!

„As Heizoel24, we are particularly impressed in our cooperation with Payla that the white label installment payment has led to significantly more customers taking advantage of the installment payment option – compared to other offers on the market. We would particularly like to emphasize the tailor-made adaptation of the solution to the special needs of the heating oil market, such as fluctuating delivery volumes Payla has not only understood these challenges, but has adapted its solution perfectly to them.“

„Rossmann is extremely satisfied with Payla’s Buy Now, Pay Later solution. It allows us to act as a billing provider in our own name, which has significantly improved our conversion rate and customer satisfaction. What we particularly like about working with Payla is the seamless integration of the payment solution into our app and the close and collaborative partnership on an equal footing.”

“For our e-commerce customers, purchase on account is a decisive turbo for the conversion rate at checkout. Nevertheless, you can’t leave such a key service to other brands, you have to fly the flag yourself. With Payla as a reliable white-label BNPL provider, our customers strengthen their own brand without having to bear the risk of buying on account. So it’s a win-win for our customers – that’s more than worth a recommendation!”